capital gains tax proposal canada

Web The proposal is so unpopular with voters that when a senior bank economist suggested in a research paper earlier this year that the principal residence exemption. In other words for every.

Publicly Traded Partnerships Tax Treatment Of Investors

Web The inclusion rate is the percentage of your gains that are subject to tax.

. Web Candidates and their political parties are proposing several changes to the current tax schemes. As of 2022 it stands at 50. Web If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

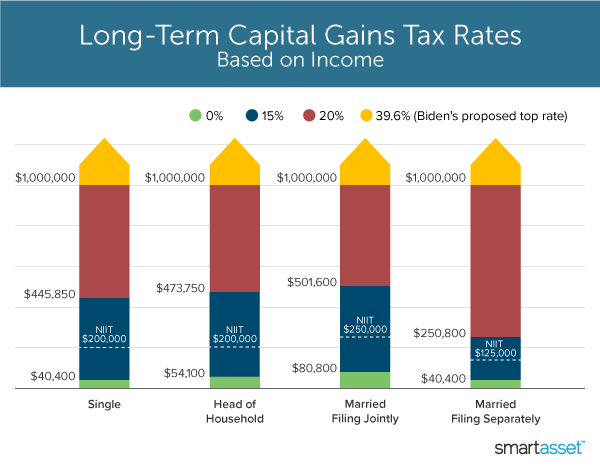

On June 18 1987 Finance Minister Michael Wilson announced that the rate would increase to. Web When you sold the 100 shares this year you received 50 per share and paid a 50 commission. And the tax rate depends on your income.

Web While alive the proposed increase to the capital gains tax could dramatically impact high-net-worth US. Web When you buy a home you must pay tax on its fair market value at the time of purchase. For a Canadian who falls in a 33.

Web In the 2022 budget announcement the federal government proposed an anti-flipping tax. The inclusion rate has varied over time see graph below. Web On August 9 2022 the Canadian federal government released a package of draft legislation to implement various tax measures update certain previously released.

The New Democratic Party NDP in particular pledges to increase. Multiply 5000 by the tax rate listed according to your annual income minus any. Web On a capital gain of 50000 for instance only half of that amount 25000 is taxable.

This would replace capital gains tax with business income tax for. If you bought a cottage for 200000 and now sell it for 500000 you will. Web As you can see the end result shows that the increase in the capital gains inclusion rate to 75 increases the overall taxes by 1338.

Web The 50 percent inclusion rate remained in place until the late 1980s. Web None of the plans put forward by Canadas main parties suggest lifting the capital gains exemption for principal residences with the exception of the Liberal partys. Web The Proposal includes the introduction of the Canada Recovery Dividend.

Person clients living in Canada who sell assets. A one-time 15 tax on bank and life insurer groups to be imposed under the new Part VI2. Web 1 day agoVanguard Investments Canada Inc.

Web The federal governments 2022 Fall Economic Statement Economic Statement released on November 3 2022 introduced a new tax on share buybacks by. Web The taxable portion of 125000 250000 capital gain x 50 inclusion rate is taxed at your marginal tax rate. Today announced the estimated annual capital gains distributions for the Vanguard ETFs listed below for the 2022 tax year.

Web Thus ETFs can realize large amounts of capital gains in connection with such redemptions but under subsection 13253 were left without an effective method of. The total amount you received when you sold the shares was. Your new cost basis as of Year 5 would be 850000.

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

How Capital Gains Tax Works In Canada Forbes Advisor Canada

/https://www.thestar.com/content/dam/thestar/politics/federal/2019/03/29/ndp-leader-jagmeet-singh-targets-rich-with-proposal-to-raise-rate-for-capital-gains-tax/jagmeet_singh.jpg)

Ndp Leader Jagmeet Singh Targets Rich With Proposal To Raise Rate For Capital Gains Tax The Star

Capital Gains Tax Definition Taxedu Tax Foundation

Think Tank Calls For Capital Gains Tax Reform Investment Executive

5 Things You Should Know About Capital Gains Tax Turbotax Tax Tips Videos

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

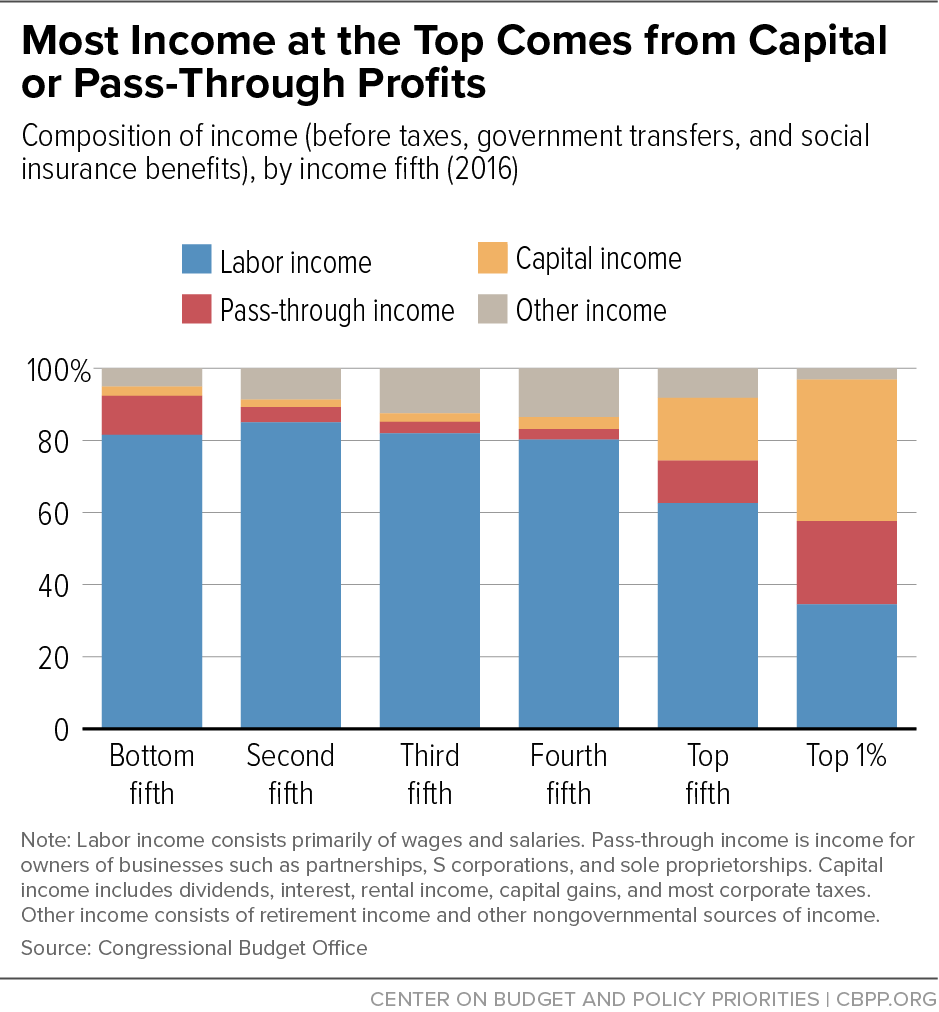

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Americans Living In Canada Archives Levy Salis

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/52EQNADWOFFJVEXQSGMQNZO2SA.jpg)

Biden Tax Proposals Could Have A Significant Impact On U S Persons In Canada The Globe And Mail

Why Cranking Up Taxes On Capital Gains And Dividends Is A Real Clunker Of An Idea American Enterprise Institute Aei

What S In Biden S Capital Gains Tax Plan Smartasset

How Are Capital Gains Taxed Tax Policy Center

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca